What You Need to File for 2025

Updated as of August 2025 – Rules can change—confirm the latest before filing.

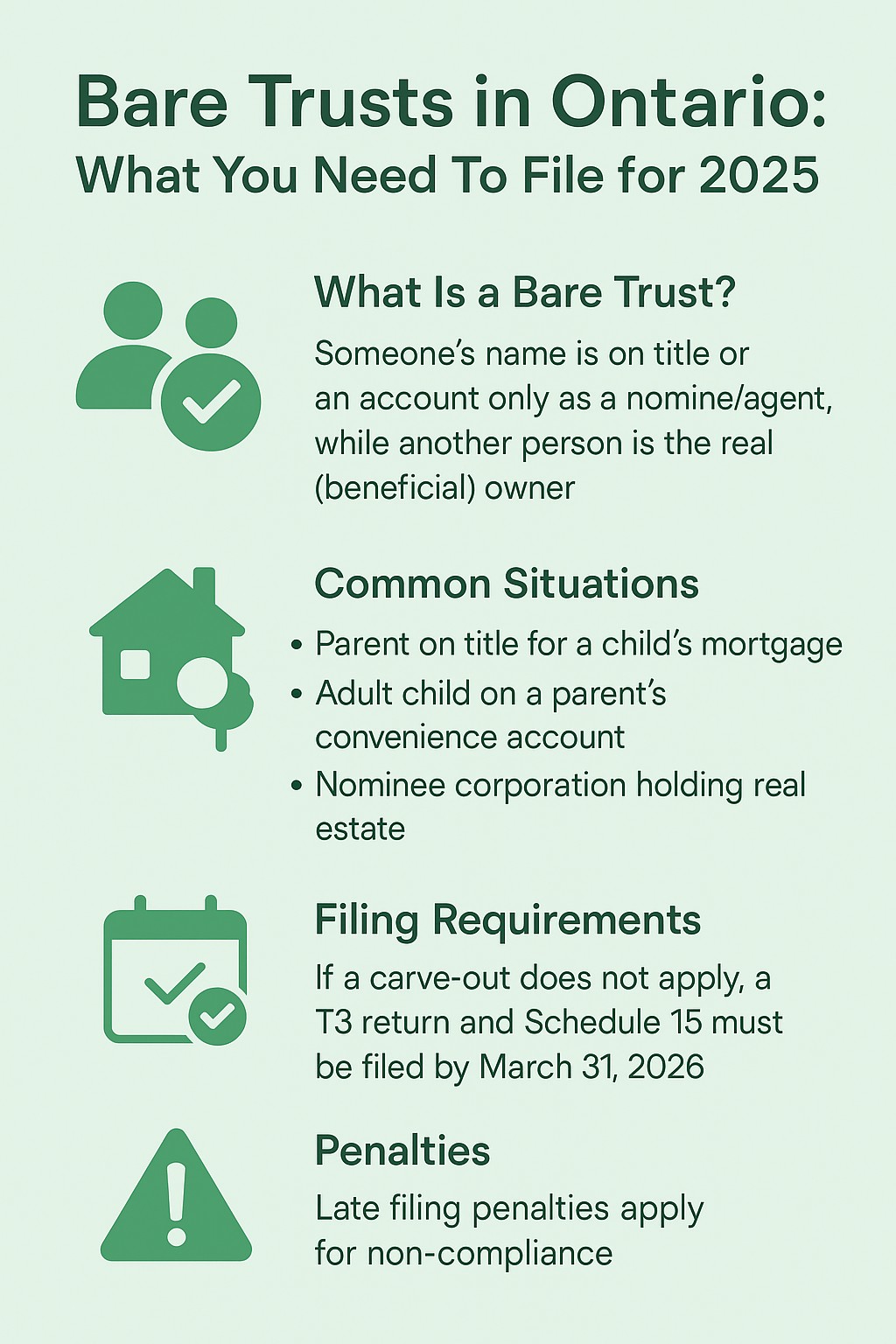

What is a “bare trust”?

A bare trust exists when someone’s name is on title or an account only as a nominee/agent, while another person is the real (beneficial) owner who enjoys the benefits, bears the risks, and makes the decisions.

Do I have to file?

For 2023 and 2024: The CRA announced bare trusts did not have to file a T3 return or Schedule 15 unless the CRA directly requested it.

For 2025 (filed in 2026): On August 12, 2024, the Department of Finance released draft legislation introducing a clearer “deemed trust” concept and carve‑outs for years ending after December 30, 2025. Confirm enactment status when you prepare your 2025 filing.

Common situations in Ontario that often indicate a bare trust

- Parent or child added on land title solely to help with a mortgage or for probate planning;

- Adult child on a parent’s bank account “for convenience”;

- Nominee corporation holding Ontario real estate for the true owner;

- “In Trust For (ITF)” accounts for minors (fact‑specific).

Proposed 2025 carve‑outs (if enacted)

- True joint owners: every legal owner is also a real beneficial owner (e.g., genuine joint bank/investment accounts).

- Family home (related persons): legal owners are related individuals and the property could be designated a principal residence of one or more legal owners.

- Spousal home: title in one spouse’s name for the use/benefit of the other, and it could be the principal residence.

- Partnership property: property held solely for a partnership’s use/benefit, each legal owner is not a limited partner, and a partnership return is filed.

- Certain court‑ordered holdings, resource properties, and specific charity/NPO cash arrangements.

What to file and when

- T3 Trust Income Tax and Information Return with Schedule 15.

- Deadline: 90 days after year‑end (Dec 31, 2025 year‑end → due Mar 31, 2026).

- Trust account number: obtain a T3 account number before e‑filing (online or Form T3APP).

- Schedule 15 details needed for each reportable person: full name, address, date of birth (individuals), jurisdiction of residence, and SIN/TIN. Also report anyone with the ability to influence trustee decisions on income or capital distributions (fact-specific).

60‑second self‑check

- Is someone on title or an account purely “in name only”?

- Does that person not share benefits and not direct decisions?

- If jointly owned, are all legal owners also real owners?

- Is the property a family/spousal home?

- Is it partnership property with a partnership return being filed?

Penalties

- Late filing (no tax owing): $25/day (min $100; max $2,500).

- Knowing or gross‑negligent failure: greater of $2,500 and 5% of the highest FMV of trust property in the year.

Separate from the Underused Housing Tax (UHT)

T3/Schedule 15 is separate from the UHT return (UHT‑2900) for Canadian residential property. UHT may still require a filing even when no T3 is required.

Examples

Parent on title for child’s mortgage: Historically a bare‑trust pattern. Under the proposals, many family‑home cases would be excepted in 2025 (confirm enactment).

Convenience joint bank account: Often bare; likely in scope unless an exception applies.

Genuine joint investment account: Not bare; in the proposals, no enhanced reporting.

What to gather now

- List of assets where legal and beneficial ownership differ.

- Names, addresses, DOBs, jurisdictions of residence, SIN/TINs for trustees, beneficiaries, settlors, and controlling persons.

- T3 account number (or be ready to register/submit T3APP).

We can help

We’ll confirm whether a carve‑out applies, register a T3 account, prepare T3 + Schedule 15, and coordinate UHT where needed. The bare trust reporting rules in Canada are currently evolving, and proposed legislation remains subject to change. Taxpayers are advised to carefully and frequently review their reporting requirements and obligations. For guidance specific to your circumstances, please contact our office with any questions.

Helpful links

Disclaimer: General information only — please contact our office if you have questions or would like advice on how these rules apply to your situation